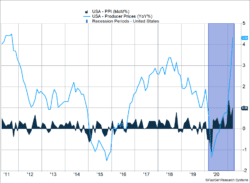

Producer prices climbed 4.2% last week (Figure 1). Energy prices contributed to the largest gain since the index rose 4.5% in September 2011. The jobs market continues to see a high level of initial jobless claims while steady progress is being made in reducing the number of unemployed receiving continuing benefits. Last week initial claims rose 16,000 to 744,000 and continuing claims dipped by 16,000 to 3.7 million.

Key Points for the Week

- Inflation data will likely heat up temporarily as the deflationary months during the most severe lockdowns in 2020 are replaced by above-average inflation. Producer prices rose 4.2% over the last year.

- The jobs market is showing mixed signs as initial unemployment claims increased 16,000 last week while job openings rose 268,000 in February as restaurants picked up hiring.

- S. service business are experiencing growth based on a non-manufacturing report of 63.7, which was the highest reading ever and well above expectations of 58.5.

U.S. service businesses are finally experiencing a comeback. The ISM non-manufacturing index rose more than 8 points to an all-time high of 63.7. All business sectors experienced gains in March. Employment has been the slowest part of the index to recover but has made great strides. Business activity and new orders have been the strongest segments.

Stock markets reacted positively to the week’s events. The S&P 500 gained 2.8% and is now up 10.4% for the year. The global MSCI ACWI index added 2.0% last week. The Bloomberg BarCap Aggregate Bond Index gained 0.4%.

This week will be a busy one for data releases. Retail sales and industrial production from the world’s two largest economies will headline the week’s releases. Inflation has been a hot topic, and the U.S. and the eurozone will also release Consumer Price Index data.

Figure 1

The Price is Right

In 1972, just as inflation was about to take off in the United States, Bob Barker started encouraging contestants to “Come on down!” on the Price Is Right game show. Little did the show producers know that guessing prices was going to get harder as inflation twice surged above 10% over the next decade. During this period the pricing mechanism was not right in the U.S. economy.

Some investors are worried we are about to experience a repeat performance. The Federal Reserve has supported the economy with very low interest rates and ample quantitative easing. The purchase of government bonds by the Fed has also helped the federal government run higher deficits without facing the risks of rapidly increasing interest rates. It seems like the seeds of higher inflation are being sown.

Yet, our analysis shows the concerns are overblown. The risks of 1970s inflation or even inflation that is half that high seem relatively small and manageable. A big reason is the differences between the 1970s and the 2020s are large, and the trend has moved decidedly in favor of lower inflation in the last 50 years. The table below provides several comparisons between the decades:

| Area | 1970s | 2020s |

| Energy | Energy shortages and oil boycotts pressured prices | Abundant energy available domestically |

| Energy Intensiveness | Energy intensive and no limited substitutes | Less energy intensive and energy substitutes gaining share |

| Population | Baby boomers entering the workforce | Slower population growth |

| Price Information | Pricing information harder to source | Internet makes finding cheap prices easier |

| Top Industries | Autos and energy | Technology and communications |

| Competition | Lower global competition | Higher global competition |

| Mindset | High-inflation mindset | Low-inflation mindset |

As Table 1 shows, the economic conditions were quite different in the 1970s. The U.S. is producing more of its own energy today, and that energy is less important to the economy. U.S. energy intensity fell about 2% a year from 1970 until 2011. In the last decade, the introduction of hybrids, electric cars, and additional forms of renewable energy have further undercut the power of a potential energy shock on the U.S.

The 1970s coincided with Baby Boomers entering the workforce and buying their first cars and homes. That demand helped to push prices higher. Raising prices is much more difficult today than in the 70s. First, pricing information is readily available, so the penalty for raising prices can be felt more swiftly than in the past. The types of industries generating demand are also less prone to price increases. Technology-focused businesses look to improving performance and achieving wider reach rather than increasing prices. Global competition makes price increases hard to implement as there are more true competitors. Autos are a good example. In the early 70s, the “Big Three” had nearly an 85% market share. By 2018, it was 44% as foreign manufacturing increased competition.

The lack of inflationary pressure in the economy was witnessed just before COVID-19 and shows how the economy has changed. Unemployment had reached a 50-year low; yet, the Fed was cutting rates because inflation remained below the desired level. The same unemployment rate 50 years ago likely contributed to a period of rising inflation. We live in a different world, and a low-inflation mindset remains.

The next few months will likely show increased inflation. We see this as a temporary statistical effect. Yearly comparisons are dropping off months last year when price increases were negative, but they still include the mid-year price rebound. Some inflation measures may creep over 3%. Supply disruptions or demand shifts may push the prices of some goods sharply higher for a few months. These are likely to be temporary.

Those forecasting a return to high inflation are likely to be disappointed, especially if they end up on the Price Is Right. Contestants win by guessing the closest price without going over the actual value, and it seems like those fearing the worst are estimating too high.

—

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds.

https://www.eia.gov/todayinenergy/detail.php?id=10191

https://en.wikipedia.org/wiki/The_Price_Is_Right

https://www.ishares.com/us/products/239726/

https://247wallst.com/investing/2010/09/21/americas-biggest-companies-then-and-now-1955-to-2010/

https://ghpia.com/slowing-population-growth-as-an-economic-problem/

Compliance Case #01004685